The Bureau of Labor Statistics released unexptected employment data this morning in the form of the “Jobs Report” resulting in a decrease in mortgage rates. Mortgage rates are senstiive to the jobs report because jobs are what provide the income that is spent to power the economy.

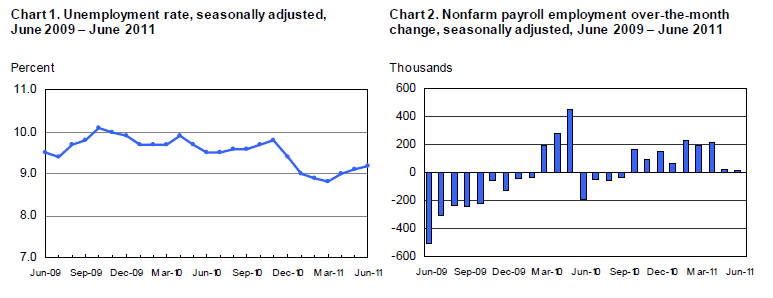

The data released showed that Nonfarm payroll employment was essentially unchanged in June (increase of 18,000 jobs, lower than expected), and the unemployment rate was little changed at 9.2 percent. Since the market was expecting higher job growth, the data was disappointing, which is good for mortgage rates.

From the Bureau of Labor Statistics Report:

The number of unemployed persons (14.1 million) and the unemployment rate (9.2

percent) were essentially unchanged over the month. Since March, the number of

unemployed persons has increased by 545,000, and the unemployment rate has

risen by 0.4 percentage point. The labor force, at 153.4 million, changed

little over the month.

Mortgage rates are once again at extremely low levels due to weaker than expected economic data. This means that although rates were expected to have moved higher by now, we have a little bit more time to lock in low rates at their current levels. If you need help determining if you can benefit from the low rates available today, we can help!

About The Author: Karengustin

More posts by karengustin